9 Ways Our Experts Can Simplify Your Insurance Bookkeeping

Insurance bookkeeping becomes a grind when your systems, statements, and commissions refuse to line up. You feel the pressure every time numbers slow your workflow instead of supporting it. You also see how missing one detail can cause bigger problems across your agency. That is why letting specialists handle the financial routines changes everything.

Take the financial burden off your plate. Schedule a consultation with our insurance bookkeeping experts today.

Book Now

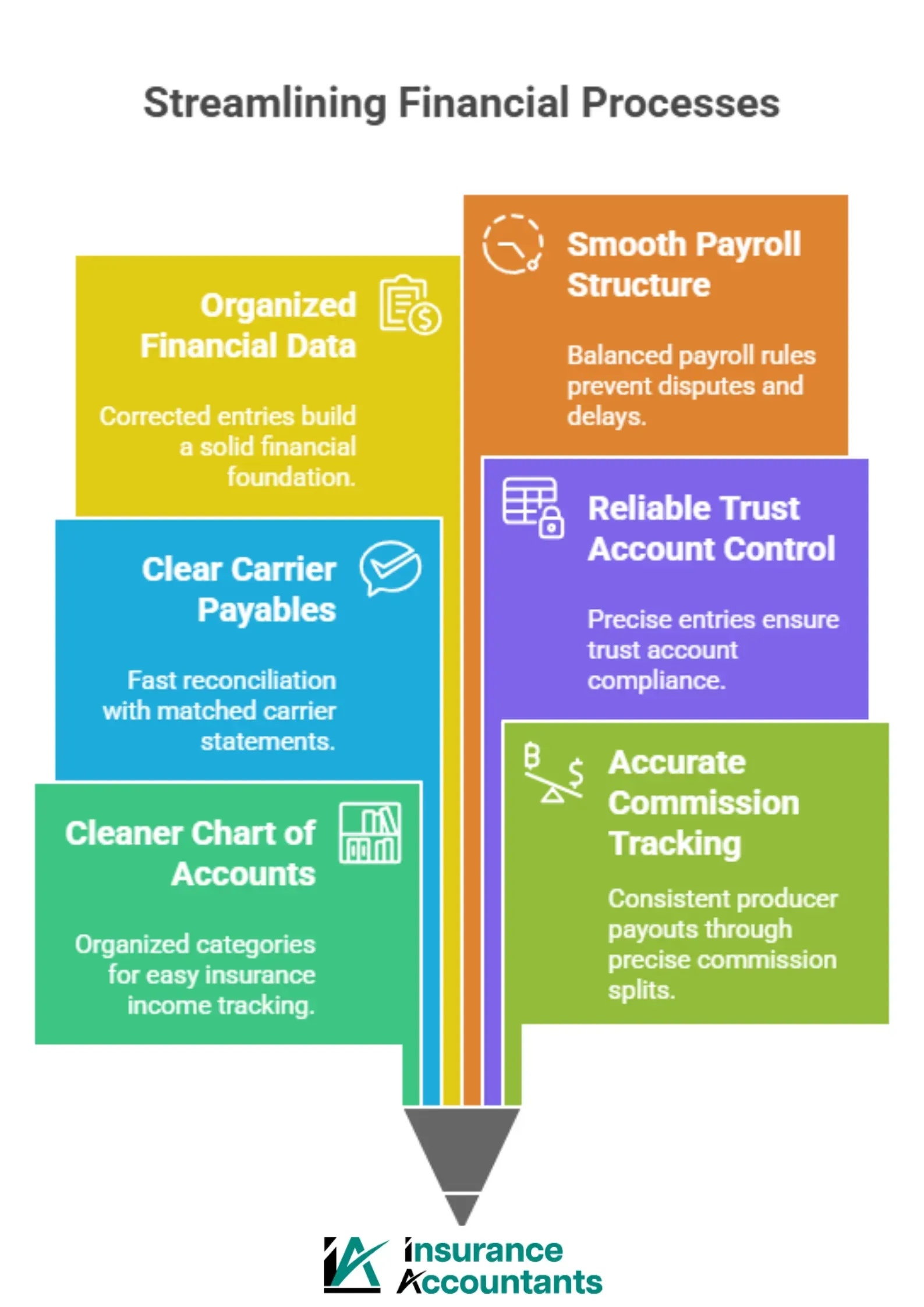

1. A Chart of Accounts Built for Insurance Work

You lose hours when your chart of accounts is cluttered, inconsistent, or built like a generic template. You jump between categories that do not match the flow of insurance income, which forces you to troubleshoot simple tasks. You also deal with missing accounts or mislabeled entries that distort your numbers.

Our team rebuilds your chart of accounts around the way insurance money moves. We map commission income, trust activity, carrier balances, and premium receivables into clean, structured categories. You finally get reports that reflect what is actually happening inside your agency.

2. Commission Tracking That Does Not Trigger Headaches

Commission errors always hit the hardest, especially when producers expect accurate numbers. You deal with mismatched splits, late rollups, confusing overrides, and invoice discrepancies that never match what your system is showing. One missed adjustment can derail an entire pay cycle and create friction across your insurance industry operations.

Our insurance bookkeeper tracks commission activity with precision and consistency, fitted to your agency’s workflow. Our team manages splits, rewrites, reversals, and exceptions without disrupting payroll or causing invoice inconsistencies. Your producers receive clear payouts without last-minute fixes. You reduce tension because your compensation structure finally runs smoothly.

3. Carrier Payables That Actually Reconcile

Carrier statements almost never match your system the first time you check them. You deal with timing issues, missing transactions, and incorrect carrier receipts that throw off your financials in ways that are hard to catch. These inconsistencies slow your month-end closing every single time and damage the accuracy of your records.

Our team identifies variances quickly and realigns your books with clean carrier reporting. We match posted activity with carrier statements, resolve timing discrepancies, and correct incomplete entries to streamline your entire reconciliation process. You get accurate carrier payable reports you can trust.

4. Trust Account Management That Passes Every Audit

Trust accounts bring pressure because they require absolute precision. One mistake places your agency at regulatory risk. Audits become stressful when you know your trust activity is not perfectly documented, and you lose the peace of mind you need to stay confident in your numbers.

Our accounting services maintain your trust account with regulation-level accuracy. We track deposits, disbursements, and transfers while following NAIC guidelines. Your books stay audit-ready without the manual stress you usually face. You stay compliant without spending hours verifying each movement.

5. Data Cleanup That Stops Turning Your Books Into Confusion

You cannot rely on your numbers when your books are cluttered, inconsistent, or filled with entries that never matched your agency’s activity. You get stuck digging through old transactions, outdated balances, or duplicates that distort your view of income, payables, and cash flow. This slows your workflow and makes simple tasks harder than they should be.

Our team removes bad entries, corrects old mistakes, and reorganizes your books so your bookkeeping setup feels solid again. We restore structure across commissions, carrier activity, producer balances, and trust transactions. This gives you cleaner data for insurance financial management and more accurate planning. Your books stop working against you and finally reflect what is happening inside your agency.

6. Payroll that Handles Producer Structures Correctly

Insurance payroll becomes heavy when you mix salary, commissions, bonuses, and shifting producer incentives. You deal with timing conflicts, incorrect splits, or outdated rules that no longer match your current structure. Every cycle turns into a scramble to verify entries that should already be correct.

Our specialists manage payroll processing and financial management on your behalf. We coordinate compensation activity, apply updated rules, and clean up inconsistent entries. You save time and prevent paycheck disputes before they even surface.

7. Insurance Bookkeeping Automation That Removes Repetitive Work

Manual entry slows everything down when your team repeats the same actions across multiple systems. You lose hours fixing avoidable errors and tracking updates tied to insurance policies that should already be automated. These delays pull your focus away from clients.

Our experts in insurance accounting services refine the automation tools you already use, including your current AMS: EZLynx, Applied Epic, or AMS360. We adjust posting rules, clean up commission setups, and organize carrier configurations so your workflow stays tight. You cut repetitive entries and reduce human error immediately.

8. Compliance and Reporting That Stay Audit Ready

Regulatory updates shift frequently, and you feel the pressure each time something changes. Audits become stressful when you are not fully certain your books meet the latest expectations. You risk violations without even knowing it. Compliance becomes a source of worry that never seems to leave your desk.

We follow the NAIC’s Accounting Practices and Procedures Manual to meet required insurance accounting and compliance standards. We update and maintain financial records to meet what regulators expect. Your agency stays protected without spending your entire week checking rules.

9. Scalable Support No Matter How Fast You Grow

Growth exposes weak accounting processes instantly. When production increases, new producers join, or more carriers are onboard, your system will show its limits fast. An insurance bookkeeper removes those pressure points with scalable workflows for higher volume bookkeeping for insurance agencies. You grow without worrying if your books can keep up.

Why Working With an Insurance Bookkeeper Gives You an Edge

An insurance bookkeeper understands the financial rhythm of an agency, not just standard accounting steps. You get support that adapts to shifting premium volumes, seasonal bind activity, and carrier delays without throwing off your books. This level of structure keeps you focused on clients instead of chasing down system mismatches or correcting past entries. You run your agency with more stability and accuracy.

Where Stronger Books Lead Your Insurance Agency Next

When your financial systems stay clean and organized, every part of your agency runs with fewer stalls. You guard your time, sharpen your accuracy, and remove the stress that usually comes from juggling back-office work. This is the level of control you gain when your bookkeeping sits with experts who understand how daily activity shapes your balance sheet from the ground up.