What Is AMS360 and Why Training Is a Must for Insurance Agency Efficiency

Managing an independent insurance agency means balancing policies, accounting, renewals, commissions, and compliance all at once. You rely on management software to keep operations organized, but efficiency slips when your team only understands parts of the system. Those gaps show up as mistakes, stalled tasks, and extra work that shouldn’t be needed. So, what is AMS360 really doing for your team if no one is trained to use it the right way?

Have Insurance Accountants manage your AMS360 accounting and reduce the load on your team.

Get AMS360 Accounting SupportWhat Is AMS360 and Why Training Makes the Difference

Most agencies use AMS360 by Vertafore every day, but not everyone understands what it is built to do. What is AMS360 really meant to be for your team? It is an Agency Management System that centralizes insurance client records, policy activity, and accounting workflows. It also supports task workflows, document storage, commission tracking, and carrier integrations across the agency.

Many agencies adopt AMS360 insurance software, expecting immediate gains. The software works, but efficiency stalls when users rely on partial workflows or manual workarounds. Training bridges that gap by showing your team how the system is meant to function as a connected workflow, not a set of isolated screens.

When your team is properly trained, AMS360 becomes more than a place to store information. It improves visibility across daily agency operations. The insurance agency software market is projected to reach USD 5.03 billion by 2032, showing how central systems like AMS360 have become.

Why AMS360 Training Improves Day-to-Day Efficiency

Daily slowdowns rarely come from workload alone. They usually come from extra steps, unclear processes, and inconsistent system use, which AMS360 training directly fixes by showing your team how to work inside the platform correctly.

This is paragraph text. Click it or hit the Manage Text button to change the font, color, size, format, and more. To set up site-wide paragraph and title styles, go to Site Theme.

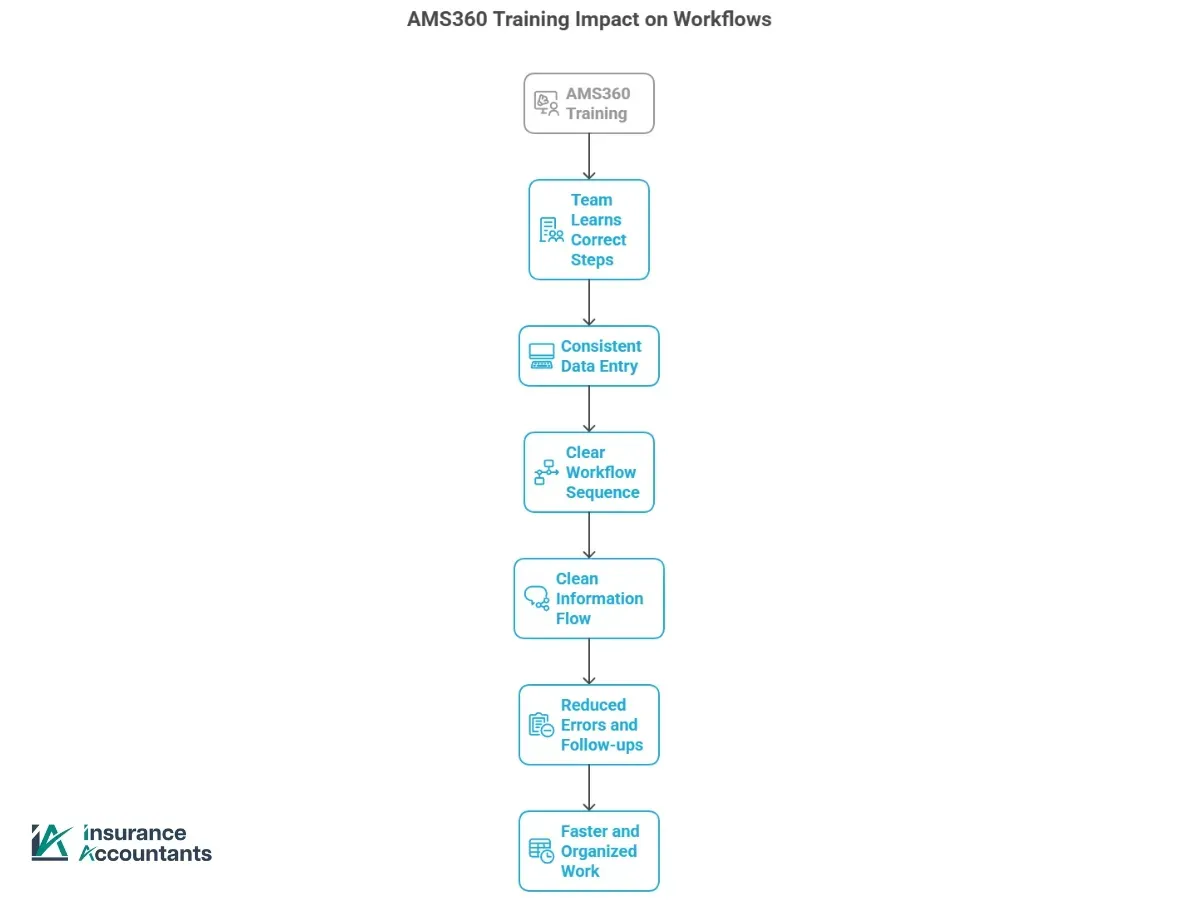

How AMS360 Training Improves Daily Workflows

Proper training in AMS360 accounting helps teams follow the right steps each day, which reduces errors and keeps work moving smoothly across the agency.

Why Consistency Matters in AMS360

When an independent agency uses AMS360 differently, small mistakes build up fast. One skipped field or misplaced entry can affect policy service, accounting work, and follow-ups later on. Training creates one shared way of working inside the system, so tasks are completed fully and in the right order. That consistency reduces rework and helps teams move through daily responsibilities with fewer interruptions.

How Untrained AMS360 Usage Slows Agencies Down

When AMS360 training is skipped, the system can appear to work just fine. The real problems show up later, once small errors start stacking up, and cleanup becomes routine.

- Policies get entered, and invoices go out, but issues stay hidden until corrections are needed

- Accounting teams manually adjust entries that should post automatically

- Agents create duplicate client records because search tools are not used consistently

- Policy changes are logged inconsistently, causing confusion during renewals or audits

- Small gaps force teams to pause work to confirm information that should already be complete

Each of these issues adds friction to daily work. Over time, small inefficiencies turn into measurable productivity loss. Training removes these patterns by aligning how everyone uses the system.

Accuracy Depends on System Knowledge

Accurate data comes from consistent system use. AMS360 applies structure only when users understand how fields and workflows connect, and training shows how each action affects downstream results.

Without training, shortcuts feel minor but lead to commission errors, misposted accounting entries, and confusion over who is responsible for fixing issues. Trained users see why each step exists and how it supports clean data.

These issues often surface during reconciliation, commission reviews, or month-end close. When accounting teams spend hours fixing entries, the system becomes a drag on daily work.

Insurance Accountants supports agencies by aligning AMS360 training with day-to-day accounting execution, so records stay clean and month-end work stays under control.

Talk to an AMS360 Accounting SpecialistWhy AMS360 Training Supports Agency Growth

As your agency grows, small workflow gaps become harder to manage. AMS360 training helps simplify insurance agency management and keep work consistent as volume increases.

- Manage higher workload: More clients and policies increase daily activity. Training helps ensure your team follows the same steps, so insurance agency management stays organized as volume grows.

- Onboard new hires faster: New staff learn one standard way to work inside AMS360. This simplifies training and supports smoother integration into daily operations.

- Keep records consistent: Standard system use keeps information complete and aligned across roles. This supports real-time access to financial accuracy as your book of business expands.

- Maintain steady processes: Training helps you rely on established workflows instead of rebuilding processes each year. Strong system integration keeps daily operations steady as your agency grows.

- Limit manual adjustments: Proper system use in terms of accounting for insurance agencies reduces the need for manual fixes. Integrated workflows allow updates to move through the system in real time instead of being corrected later.

- Define responsibilities across roles: Consistent system use helps ensure each role knows what to complete and when. This simplifies handoffs and strengthens integration across your insurance agency management process.

What AMS360 Training Looks Like in Practice

Effective AMS360 training focuses on real agency work instead of generic system walkthroughs. The goal is to help your team use AMS360 correctly during everyday tasks.

- Uses real scenarios like policy changes, renewals, and daily account service

- Covers the full policy lifecycle, so information flows cleanly between roles

- Trains accounting workflows, including transactions, commissions, and reconciliation

- Reinforces proper data entry standards so information is completed fully and consistently

- Addresses common mistakes teams make during daily system use and how to avoid them

Who Should Be Included in AMS360 Training

AMS360 training works best when it includes everyone who touches the system, not just one role. Producers, service staff, and accounting teams all interact with the same records, and gaps often happen when only part of the team is trained.

Agencies see better results when new hires receive training early, and existing staff refresh their skills as workflows change. Training the full team at the right time helps keep daily work aligned and prevents inconsistent habits from forming inside the system.

AMS360 Insurance Software Requires Ongoing Learning

AMS360 evolves through updates and feature changes. Agencies that treat training as a one-time task fall behind. Ongoing learning keeps workflows aligned with system changes and agency growth. As your agency adds carriers, lines, or staff, workflows should adapt. Regular training helps your team stay confident using AMS360 insurance software as operations scale.

If ongoing training is not practical, agencies can also choose insurance accounting services to handle accounting-related tasks inside AMS360. This option lets your team stay focused while experienced specialists manage the accounting work within the system.

Book a consultation with Insurance Accountants and put AMS360 to work instead of working around it.

Get AMS360 HelpWhy AMS360 Training Is Not Optional for Insurance Agencies

AMS360 training is a must. When teams are not trained, agencies become dependent on a few “power users” who understand the system. That creates bottlenecks, coverage gaps during absences, and risk when key staff leave. Training spreads system knowledge across the team so daily work does not stall when one person is unavailable.

Training helps your team use AMS360 correctly for accounting tasks, reducing missed postings and follow-ups caused by incomplete or out-of-sequence entries. Schedule a consultation with Insurance Accountants and speak with our AMS360 accounting experts.